Tax Rates

How to add tax rates

Things to keep in mind regarding taxes: When you first setup your taxes it is best to re-name and utilize the existing taxes that have never been used that are already in the system. As once a tax is created you typically cannot delete it. Also keep in mind that when it comes time for a tax rate to change you will keep all your current taxes that you have setup so you have tax history and you will add an additional Tax Rate and then activate it in the Tax Types with a new Tax Type. You will keep all your existing Tax Rates and Types and make the new one the default typically.

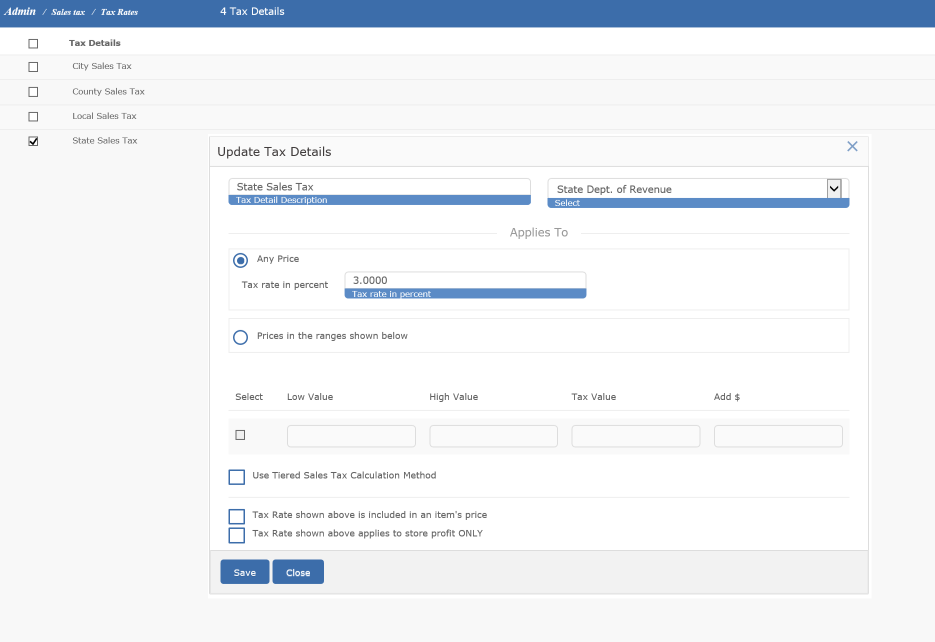

The Tax Rates is where you will set up your actual tax rates. Go to ADMIN and then double click on TAX RATES and either open a default tax rate or click on ADD to add a new tax rate.

Create a list of "tax rates." Each rate/detail points to a taxing authority. It also contains a name for display purposes (e.g., "State Sales Tax" or "Denver City Sales Tax"). Finally, a tax rate/detail contains either one rate, or a list of rates by price. Taxing by price handles some special cases or luxury taxes. For most cases, there will be a single tax rate percentage entered. It is also common for galleries to simply put the whole tax rate in one tax detail/rate screen as they will simply use that for tax purposes and they do not want to itemize every tax rate/detail or authority.

If you still want to separate tax rates/details, you should only setup one Tax Rate/Detail for each place you need to pay taxes to. For example if you pay a City Tax of 5% and County Tax of 1% to Colorado Dept of Revenue then you should only create one Tax Rate/Detail for 6%.

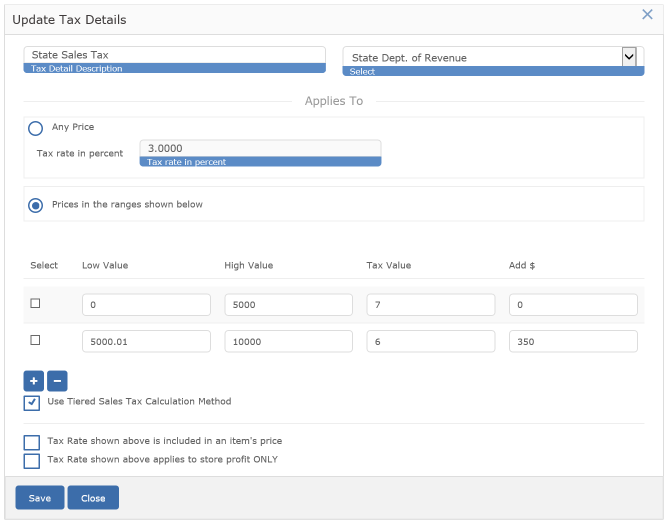

Tiered Taxing

If your situation requires multiple taxing for items then you will need to go into Tax Rates and check the appropriate box.

In this example, we have all items at $5000 and below at a 7% tax rate. Anything above $5000 is at a 6% tax rate. We have to add the $350 to the second line to cover the tax at $5000 and below.