Taxing Authorities

How to add tax authorities

Things to keep in mind regarding taxes: When you first setup your taxes it is best to re-name and utilize the existing taxes that have never been used that are already in the system. As once a tax is created you typically cannot delete it. Also keep in mind that when it comes time for a tax rate to change you will keep all your current taxes that you have setup so you have tax history and you will add an additional Tax Rate and then activate it in the Tax Types with a new Tax Type. You will keep all your existing Tax Details and Types and make the new one the default typically.

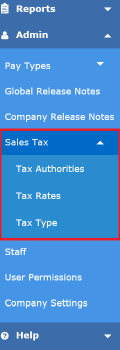

In order to set-up all applicable tax types, start from ADMIN. The three tax options will be your "Tax Authorities," "Tax Rates" and "Tax Type." Masterpiece can now handle Value Added Tax and Sliding Tax Rates.

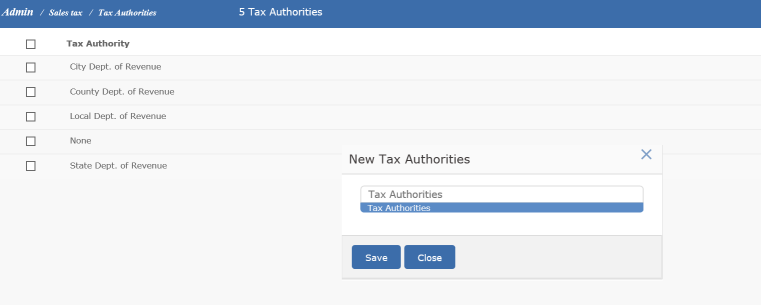

Start by creating a list of "taxing authorities." This list is maintainable by the user and it may include such items as: "State of Colorado," "City of Denver," "RTD," "Stadium District," etc.

Note in the screen shot below, there are some default tax authorities set up. You can simply double click on each one to rename them.

There are no sales tax rates specified here, it is simply a list of taxing authorities for whom the users must collect/submit sales taxes to. A separate table of taxing authorities is required since more than one "tax rates" (see Tax Rates) may apply to a single taxing authority.

You should only setup one Tax Authority for each place you need to pay taxes to. For example if you pay a City Tax of 5% and County Tax of 1% to Colorado Dept of Revenue then you should only create one Tax Authority for the Colorado Dept of Revenue.